Betting Against Media Clubs: When Popularity Distorts Odds

In modern sports betting, price formation is influenced not only by statistics and form, but also by public perception. Media-driven clubs attract disproportionate betting volumes, often forcing bookmakers to adjust odds away from objective probability. This creates a specific market inefficiency that experienced bettors actively analyse and exploit.

Why Media Clubs Consistently Attract Overpriced Support

Media clubs are teams with massive global exposure, strong branding, and a constant presence in news cycles. Their matches generate emotional engagement, not just analytical interest. For bookmakers, this means a predictable influx of bets regardless of sporting context.

Public bettors tend to overestimate the strength of well-known clubs, especially in high-profile leagues. This bias intensifies before televised matches, derbies, and European competitions, where casual stakes dominate total volume.

To manage risk, bookmakers frequently lower odds on popular sides pre-emptively. As a result, prices reflect betting behaviour rather than true win probability, reducing value for those backing the favourite.

The Psychological Bias Behind Popular Teams

Brand familiarity plays a critical role in betting decisions. Punters often associate historical success with current performance, even when squad quality or tactical balance has changed.

Media narratives amplify this effect by focusing coverage on star players, managerial reputations, and club history. Objective indicators such as xG trends or defensive metrics receive far less attention outside specialist circles.

This creates a structural bias where public money flows in one direction, allowing disciplined bettors to anticipate market movement rather than react to it.

How Bookmakers Adjust Lines for Public Betting Pressure

Odds compilation begins with internal models, but these numbers are rarely final. Once betting opens, traders monitor stake distribution closely, especially on matches involving high-profile teams.

When liability concentrates on a popular club, odds are shortened regardless of whether new sporting information emerges. This adjustment protects the bookmaker but distorts the implied probability.

In extreme cases, underdog prices become artificially inflated, offering long-term value for bettors willing to oppose public sentiment.

Timing Bets Against Media Favourites

Market timing is critical when betting against popular clubs. Early prices may be closer to true probability, while late odds often reflect peak public demand.

Sharp bettors frequently wait until the final hours before kick-off, when recreational money has maximised its impact. This window often provides the best price on the opposing side.

Understanding betting flow patterns is as important as analysing team data. Without this context, value opportunities can be missed entirely.

Practical Strategies for Betting Against Overhyped Teams

Opposing media clubs does not mean blindly betting against favourites. The approach requires selective filtering, strong data interpretation, and disciplined bankroll management.

Key indicators include congested schedules, tactical mismatches, inflated Asian handicap lines, and market overreaction to recent high-profile wins.

Consistent profitability comes from treating popularity as a risk factor, not a performance indicator.

Leagues and Markets Where the Effect Is Strongest

The distortion effect is most visible in leagues with global audiences, such as the Premier League, La Liga, and UEFA competitions. Clubs like Manchester United or Real Madrid routinely attract disproportionate support.

Secondary markets, including handicaps and totals, often provide cleaner value than outright match odds, as public focus remains on simple win outcomes.

Long-term data confirms that systematic opposition to overpriced media clubs can outperform random betting, provided selection criteria remain strict and emotionally neutral.

Popular articles

-

Profession of a Cybersportsman in Dot...

Profession of a Cybersportsman in Dot...The world of esports has grown tremendously over the past …

-

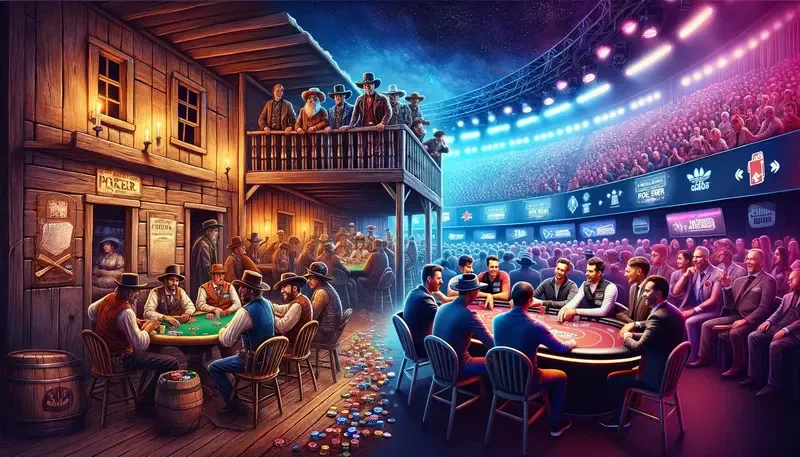

The Evolution of Sports Poker: From S...

The Evolution of Sports Poker: From S...In the vast panorama of competitive sports and games, few …

-

Jack Draper’s Renewed Conviction: A G...

Jack Draper’s Renewed Conviction: A G...In the unpredictable world of tennis, where the spirit is …